The Uneven Geography of Opportunity for Asian Americans and Pacific Islanders in Metro America

April 27, 2023

By Ryan Fukumori, Edward-Michael Muña, Vanessa Garcia, and Jennifer Tran

Contents

- Introduction

- Data and Methods

- Findings

- AAPI Residents Are Concentrated in the Least Affordable Metropolitan Areas

- AAPI Renters Face Additional Challenges That Are Not Captured by Income Figures Alone

- Metro Areas in the West and Southeast Saw Greater Declines in Affordability for AAPI Renters

- Some AAPI Groups, Especially Pacific Islanders, Face Steep Challenges with Rental Affordability

- Recommendations

- Acknowledgments

- Related Resources

Introduction

In May 2022, the National Equity Atlas released The Shrinking Geography of Opportunity in Metro America, a report that explored the landscape of housing affordability in the United States by race. The data and analysis illustrated the growing gap in access to affordable housing and opportunity-rich neighborhoods for working-class, Black, and Latinx renters from 2013 to 2019.

In that analysis, we also discovered that 71 percent of neighborhoods in the largest 100 metropolitan areas were affordable to median-income Asian American and Pacific Islander (AAPI) households. This figure was a slightly higher rate of affordability than median-income white households and a substantially higher figure than those for Black and Latinx households. However, this aggregate statistic does not adequately capture the range of experiences that AAPI communities nationwide have in accessing affordable housing, especially housing in “high-opportunity” neighborhoods — those with quality schools, safe streets, clean air, parks, reliable transit, and proximity to jobs, retail, and services. We decided that it would not suffice to publish these high-level figures on AAPI rental affordability without a deeper dive into the differences between — and within — AAPI communities nationwide.

Asian Americans and Pacific Islanders are among the fastest-growing communities nationwide. Between 2010 and 2019, the AAPI population grew by 18 percent, whereas the overall population grew by just 5 percent. By focusing on residents in the top 100 metropolitan areas, we also account for the geographies where the vast majority of AAPIs reside. AAPIs are overwhelmingly urban and suburban: 91 percent of all Asian Americans and Pacific Islanders nationwide reside in these regions, compared to 67 percent of all US residents regardless of race.1

However, the AAPI experience in the US is not monolithic. AAPI communities trace their histories across a vast array of migratory pathways, exclusionary practices, and legacies of warfare and colonialism. It is difficult to draw a singular view of affordability that does not obscure the historical differences and diverse lived experiences of AAPIs, whether looking at a single metropolitan area or across the entire nation. AAPI advocates and researchers have emphasized the importance of disaggregated data on AAPI populations to bring these intra-group distinctions into greater focus and advance equitable change specific to the needs of low-income AAPI communities. (Learn more in How We Define Affordability.)

For this follow-up report, we disaggregated the same dataset from our previous report for a more nuanced understanding of the differences in affordability between AAPI subgroups in 2013 and 2019. In this analysis, we ask three main questions:

-

How does neighborhood affordability for AAPI households differ across metros?

-

How does neighborhood affordability vary for different AAPI subgroups in the areas where data is available?

-

How many high- and low-opportunity areas are affordable to AAPIs?

Our key findings include the following:

-

AAPI residents are disproportionately concentrated in the least affordable metropolitan areas, and many metro areas with high affordability have few AAPI residents.

-

AAPI renters face additional challenges related to linguistic isolation and overcrowding that are not captured by income figures alone.

-

While the overall number of neighborhoods affordable for AAPIs remained stable between 2013 and 2019, metro areas in the West and Southeast saw greater declines in affordability that were offset by gains in other regions.

-

Some AAPI groups, especially Pacific Islanders, face particularly steep challenges with rental affordability.

Because the overall number of neighborhoods affordable to median-income AAPI renters barely fluctuated, it is harder to speak of a shrinking geography of rental affordability for AAPIs in the same way we see for Black and Latinx residents. Rather, what we see is an uneven geography for AAPI renters, where small net changes in the overall landscape mask broader disparities across geographic spaces and ethnic groups. The abundance of high-earning AAPI households in many metro areas drives up median incomes despite the many working-class AAPI residents in those regions. In addition, the relative affordability of some metros makes up for the wide-scale unaffordability of other regions in other parts of the country.

How We Define Affordability

We define an affordable zip code as one where renters making the median household income (MHI) in that particular metropolitan area spend 30 percent or less of their income on housing if they pay the median market rent for that zip code. For instance, if the MHI in a given metro area is $100,000, a household making that amount would find a particular zip code in that same metro affordable if the median market rent in the neighborhood was no more than $30,000 a year, or $2,500 a month. Were this household to pay more than $2,500 a month in rent, they would meet US Department of Housing and Urban Development (HUD) definitions for being rent burdened.

Given widespread trends in racial and class segregation, it is commonplace for some zip codes in a single city to be affordable to the median household, while other neighborhoods are not affordable. It is also possible for a single zip code to switch from affordable to unaffordable (or vice versa) over time if market rents increase faster than area median incomes during that span. In this study we examine data from two years, 2013 and 2019, to assess changes in affordability across the 100 largest US metropolitan areas (“metros” or “metro areas” for short) during the period of economic recovery between the Great Recession and the Covid-19 pandemic.

Within every metropolitan area, we can calculate the median household income for the entire population, as well as separate MHIs for population subgroups, like racial or ethnic groups. Median incomes for Black, Latinx, Asian American and Pacific Islander (AAPI), and white households often vary within a metropolitan area, which can indicate broader structural disparities with uneven impacts across populations. This means that a given zip code can vary in affordability depending on the racial group (e.g., if a median AAPI household could afford the median market rent in that neighborhood but a median Latinx household would be rent-burdened at the same cost).

In the report, we use shorthand language for the sake of readability. When we state that “X neighborhood was affordable for AAPI residents,” we mean that the neighborhood had a median market rent of less than 30 percent of the median household income for AAPI residents in that metropolitan area.

Data and Methods

To answer our research questions, we synthesized data from 2013 and 2019 across three main datasets:

1. Zip code-level data on median market rents from the Zillow Rent Index (ZRI). The ZRI is a data tool that determines the median market rent (the median monthly cost of for-rent units) within a given geographic area for a given year. ZRI data focuses on the cost burdens for households searching for available rental housing in that area, not the cost of all rental housing units in that area. Incumbent renters, who are more likely to have lower rents and/or smaller rent increases, are not included.

ZRI is a summary measure of neighborhood affordability, not a precise measure. After all, the median market rent indicates the price point at which half of all rents cost less, and half cost more. Even if we deem a given zip code unaffordable for the median household based on the median market rent, it is still possible that there are some rentals within that zip code that are affordable for the median renter. However, these affordable rentals are not plentiful, which makes the zip code financially restrictive from a macro level.

It is important to note that median monthly costs reflect listed or “asking” rents, which may or may not include the cost of utilities. As such, this measure is a proxy for the definition of rental burden set forth by HUD, which includes rent and utilities as a percentage of income.

In 97 of the 100 regions under analysis, Zillow’s data covers at least 80 percent of the renter household population in both 2013 and 2019. The three metro areas with data for less than 80 percent of the renter population are Youngstown-Warren-Boardman, Ohio/Pennsylvania (79 percent); Rochester, New York (77 percent); and Augusta-Richmond County, Georgia/South Carolina (58 percent).

2. Metro area-level data on median household incomes from the 5-Year American Community Survey. This report utilizes the MHI for all residents within each metro area regardless of race/ethnicity, as well as the median income in each metro for all AAPI households combined. In addition, we calculated the 2013 and 2019 MHIs in each region for four major AAPI subgroups (East Asians, Southeast Asians, South Asians, and Pacific Islanders) and the six most populous Asian ethnic groups (Chinese, Filipino, Indian, Korean, Japanese, and Vietnamese). To merit inclusion within our dataset, the MHI for a given region had to include at least 100 household responses in the ACS. This means that MHI data are not available for some AAPI populations (particularly Pacific Islanders) in smaller metro areas, where the sample size was too small.

In this report, the terms “median-income AAPI households” and “AAPI households at the median income” refer to AAPI households at the median household income for AAPI households within that metro. Additionally, the term “AAPI household” is shorthand for a household enumerated in the American Community Survey with an AAPI householder, e.g. the family member who completes the ACS on behalf of the entire household. This means that the people living in so-called “AAPI households” are not necessarily all AAPI, as households do not always fall within neat demographic boundaries.

We included median household incomes for all households in a given metro area, not just rental households. Homeowners can become renters and vice versa, and by including data from all households we can explore racial inequities in rental affordability more broadly.

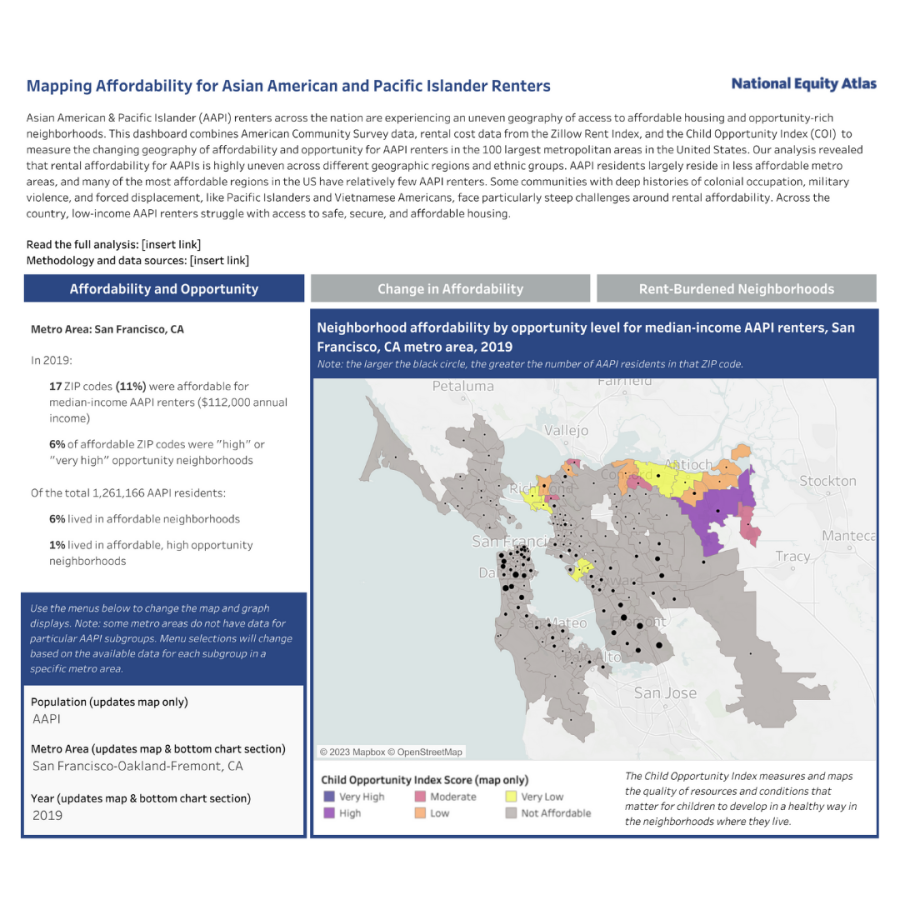

3. Zip code-level data from the Child Opportunity Index (COI), a metric devised by researchers at Brandeis University. The COI provides a relative measure of livability for children and families by scoring each neighborhood (here, zip code) along 29 indicators of opportunity across three domains: education, health and environment, and social and economic. Each zip code falls into one of five levels of opportunity (quintiles): “very high,” “high,” “moderate,” “low,” and “very low.”

We use the COI to examine the local opportunities within the neighborhoods that are affordable to median renters in a given metro. Rental affordability alone cannot ensure economic stability if the only affordable neighborhoods are in areas with existing structural disparities in health, education, employment, and other key service systems. Two metrics are of particular importance: the percentage of affordable zip codes that are high-opportunity (a COI of “high” or “very high”), and the percentage of high-opportunity zip codes that are affordable for a given population.

4. Discussions with AAPI housing justice organizations, policy advocates, and community service providers. National Equity Atlas staff conducted informational interviews with staff from 14 AAPI-led and -serving organizations across the country to cross-check our findings with practitioners’ and advocates’ experiences with the challenges that low-income, immigrant, and limited English-proficient AAPI renters face in their respective communities. We have integrated their insights, observations, and policy considerations throughout this analysis. A full list of organizations that we consulted is listed below:

• Asian Americans Advancing Justice - Atlanta (Atlanta, Georgia)

• Asian Pacific American Network of Oregon (Portland, Oregon)

• Chinese American Planning Council (New York, New York)

• City Fabrick (Long Beach, California)

• Coalition for Asian American Children and Families* (New York, New York)

• Hamkae Center (Annandale, Virginia)

• HANA Center (Chicago, Illinois)

• Hawaii Appleseed Center for Law & Economic Justice (Honolulu, Hawaii)

• Hawaii Budget and Policy Center (Honolulu, Hawaii)

• National Coalition for Asian Pacific American Community Development* (Oakland, California)

• OCA-Asian Pacific American Advocates* (Washington, DC)

• Orange County Asian Pacific Islander Community Alliance (Garden Grove, California)

• Philadelphia Chinatown Development Corporation (Philadelphia, Pennsylvania)

• Southeast Asia Resource Action Center* (Washington, DC)

* Denotes an organization that has a national scope.

A few additional notes on the terms and methods we use in this report:

• To capture the diversity of the Asian American and Pacific Islander community we present data for more specific racial/ethnic subcategories within these groups. To be considered in this analysis, respondents to the census survey must identify as Asian or Pacific Islander regardless of what additional races they report. Respondents were then sorted into racial/ethnic subcategories based on the first response to the census question on ancestry, recorded in the IPUMS variable “ANCESTR1.” As part of the analysis, all people included in our analysis were assigned to one of four racial/ethnic aggregated subcategories to aid our analysis.

- “South Asian” is used to refer to all people who identify with any of the following ancestry categories: Bengali, Indian, Pakistani, Sri Lankan, Nepali, Bhutanese, or Other South Asian.

- “Southeast Asian” is used to refer to all people who identify with any of the following ancestry categories: Burmese, Vietnamese, Cambodian, Hmong, Laotian, Thai, Indonesian, Filipino, or Other Southeast Asian.

- “East Asian” is used to refer to all people who identify with any of the following ancestry categories: Chinese, Japanese, Korean, Taiwanese, or Other East Asian.

- “Pacific Islanders” can refer to anyone identifying as Native Hawaiian or Pacific Islander alone or in combination.

• “Low-income household” is a term that can have either a loose, quantitative meaning (e.g., a household with members working in low-wage occupations or industries) or a precise definition based on HUD standards (i.e., a household earning 80 percent or less of the median income for the given metro area — the area median income (AMI)). We clarify when “low-income” refers to the latter (80 percent of the AMI). By contrast, households earning 100 percent of the AMI are “median-income,” and those earning 120 percent of the AMI are “moderate-income.”

• While we refer regularly to “zip codes” in this report, we are actually using ZIP Code Tabulation Areas, or ZCTAs, as our smallest geographic unit to align Zillow Rent Index and Child Opportunity Index data. ZCTAs are a designation that the US Census Bureau uses to produce the decennial census, whereas zip codes fall under the purview of the US Postal Service and aid in the delivery of mail. While zip codes and ZCTAs broadly overlap, zip codes are more liable to change boundaries and numbers over time. As such, ZCTAs are useful for stabilizing longitudinal data analyses that compare the same regions over time. However, “zip codes” is a more familiar shorthand for the sake of our reporting.

AAPI Residents Are Concentrated in the Least Affordable Metropolitan Areas

Nearly half of all AAPIs nationwide live in metropolitan areas with a minority of affordable neighborhoods. As mentioned in the introduction, 71 percent of zip codes in the top 100 US metros were affordable for AAPI households in 2019, compared to 28 percent for all households. In 2019, 86 of the top 100 US metros had 50 percent or more zip codes that were affordable for AAPI households. However, the 14 metros with a minority of neighborhoods affordable for AAPIs include some of the largest AAPI populations nationwide, such as the New York, Los Angeles, San Francisco, and San Jose metropolitan areas. These 14 metros alone accounted for more than 8.3 million AAPIs in 2019, which made up 51 percent of all AAPI residents living in the top 100 metros and 47 percent of all AAPIs nationwide.

In many of these metros with low rates of neighborhood affordability, AAPI renters are highly concentrated in areas that are unaffordable for median-income AAPIs.

While many of the top 100 US metros have very high rates of affordable neighborhoods for AAPI households, not many AAPI residents live in most of these areas. Only five metros — Seattle, Houston, Dallas, Chicago, and Washington, DC — have AAPI populations greater than 500,000 and have more than 50 percent of their zip codes affordable for AAPI households. The nationwide data sample might hide this uneven geographic distribution of unaffordable neighborhoods in areas with lots of AAPI renters.

From a national perspective, there are thousands of neighborhoods that are hypothetically affordable for AAPI renters, but many of those neighborhoods are in metro areas or parts of metros that have small AAPI communities, if any. While 71 percent of zip codes in the top 100 US metros were affordable for median-income AAPIs in 2019, fewer than half (46 percent) of AAPIs in those metros actually lived in those affordable neighborhoods.

AAPI Renters Face Additional Challenges Related to Linguistic Isolation and Overcrowding That Are Not Captured by Income Figures Alone

As mentioned earlier, overall rental affordability levels for AAPI households slightly exceed affordability rates for white households in the top 100 US metros. However, definitions of rental affordability solely based on income levels can miss some of the social and cultural challenges that AAPI renters face in greater numbers than white residents.

First, AAPI households in these metros are much likelier to rent than white households, and they are slightly more likely to rent than the overall population. In 2019, renters comprised 40 percent of AAPI households in these metros, compared to 29 percent of white households and 38 percent of all households combined.2 While median-income AAPI and white households face comparable levels of housing affordability across metro America, a greater share of AAPIs must navigate changes in the rental market, and a smaller share build equity in property ownership. While a larger proportion of AAPIs have achieved homeownership relative to other communities of color, the nationwide practice of racially exclusionary housing development in the 20th century has entrenched higher rates of white homeownership ever since.

Second, median income data can obscure common challenges in the lived experiences of many AAPI households, especially when compared to white renters. Our conversations with AAPI housing justice and social service organizations across the US illuminated some key barriers that AAPI tenants are likelier to face, especially low-income and immigrant renters:

-

A higher proportion of AAPIs reside in multigenerational households, with grandparents and/or additional relatives living under the same roof as parents and children. The presence of more than two income earners in such households can inflate AAPI median incomes relative to white households, and it can also lead to greater rates of overcrowding.

-

AAPI households are more likely to be nonproficient in English, which would introduce additional barriers in navigating the rental market and could impede access among linguistically isolated renters to some neighborhoods they could afford. This is especially true for residents who do not speak any of the threshold languages in which local public agencies are required to provide translated materials.

-

Affordability challenges are compounded for many AAPI older adults, many of whom live on fixed incomes in increasingly unaffordable rental markets while also facing linguistic and cultural barriers to navigating the rental market. In some metro areas, younger, higher-income AAPI residents also partake in the market forces that are imperiling their older AAPI neighbors.

Our profiles on AAPIs in the Honolulu, Atlanta, Philadelphia/New York, and Los Angeles metro areas explore more of the on-the-ground challenges that low-income AAPI tenants face in finding or keeping their housing.

While the Overall Number of Neighborhoods Affordable for AAPIs Remained Stable between 2013 and 2019, Metro Areas in the West and Southeast Saw Greater Declines in Affordability That Were Offset by Gains in Other Regions

At the national level, neighborhood affordability for AAPI renters remained more stable between 2013 and 2019 relative to the overall population. As highlighted in our earlier report, there was a substantial decline in the number of neighborhoods affordable to median-income renters in the top 100 US metros between 2013 and 2019. During those six years, there was a net loss of 1,473 affordable neighborhoods for median renters — the equivalent of one in every six zip codes becoming newly unaffordable. By contrast, median-income AAPI renters in the top 100 metros saw only a small decline in the number and percentage of affordable zip codes, from 72 percent to 71 percent (a net loss of just 64 affordable neighborhoods).

However, small overall changes in the number of affordable neighborhoods can obscure wider disparities in some areas that are counterbalanced by trends in other places. Positive and negative changes in affordability for AAPIs were concentrated in different parts of the US. The 500 zip codes that became unaffordable for median AAPI households between 2013 and 2019 were largely represented in California, Colorado, Arizona, Florida, Ohio, and Massachusetts. By contrast, the 436 neighborhoods that became newly affordable for AAPI renters over the same period were clustered in Utah, Wisconsin, New Jersey, and upstate New York. From this angle, the net loss of 64 affordable neighborhoods for AAPI renters appears much more dynamic and suggests varying regional trends that merit further attention.

Disaggregating the top 100 metros into five regions of the US — the West Coast and Hawaii, the Rockies and Southwest, the Midwest, the Northeast, and the Southeast — helps to further nuance the areas where AAPI renters face affordability crises in greater numbers. While AAPI population rates vary across regions — from 3 percent in the Southeast to 16 percent in the West and Hawaii — it is notable that AAPI population rates more than doubled the overall population growth rate in all five regions during the 2010s. The areas with the lowest percentages of AAPI residents — the Southeast, Midwest, Rockies, and Southwest — witnessed the largest growth in AAPI communities within the last decade.

Looking at the data along these national subdivisions further reveals how metro AAPIs in the westernmost states face acute affordability issues despite some of the highest median incomes in the nation. Conversely, many AAPIs in relatively affordable parts of the country may struggle to find neighborhoods with sufficient financial, educational, and health resources.

Metro areas in the West and Hawaii had the lowest rates of affordable neighborhoods for median-income AAPIs in 2019, at just 37 percent. In addition, those areas also saw the most precipitous decline in affordable zip codes between 2013 and 2019 — a 13 percentage point drop. The states of California, Oregon, Washington, Nevada, and Hawaii are home to a massive number of AAPI residents, which means an outsized number of AAPI renters must face the outsized challenges with housing affordability west of the Rocky Mountains. These metro areas represent 43 percent of the overall AAPI population in the top 100 US metros, and one of out every six residents in the westernmost metro areas is AAPI. Notably, the West and Hawaii had the steepest decline in AAPI neighborhood affordability between 2013 and 2019, as well as the lowest rate of AAPI population growth during the 2010s.

-

California’s statewide housing crisis — in terms of affordable housing and available housing overall — has long been a point of concern, advocacy, and policymaking. California is home to hundreds of thousands of low-income AAPIs who faced an increasingly hostile rental market in the 2010s. We explore some of these challenges in our profile on the Los Angeles metro area.

-

While the Honolulu metro area faces a similar affordable housing crisis, AAPI housing politics in Hawaii are unique in the context of an indigenous sovereignty and decolonization movement that has persisted for over a century. We summarize some of the particular issues around land sovereignty and class disparities in Hawaii in our profile on the Honolulu metro area.

The Rockies/Southwest and Southeast regions also saw declines in affordability for AAPIs, but these drops were less severe and started from much higher baselines. In turn, the Midwest and Northeast both witnessed slight increases in the number of neighborhoods affordable for median-income AAPI households. Nonetheless, it is important to recognize the affordability challenges that many working-class AAPI communities face in these regions outside of the West, as our profiles on the Philadelphia/New York and Atlanta metros explore.

Some of the most affordable regions of the country for AAPIs have the fewest high-opportunity neighborhoods that are affordable to median-income AAPI renters. Not all affordable neighborhoods offer the same amenities and life chances for their residents. As a whole, metros with large numbers of affordable neighborhoods also had more locales with less favorable living conditions. Over three-quarters of the metropolitan neighborhoods in the Rockies, Southwest, and Southeast were affordable to median-income AAPI renters in the 2010s, with only small declines in rental affordability between 2013 and 2019. However, in these regions, slightly more than one-quarter of zip codes affordable for AAPIs were very high or high opportunity, while nearly one-half of zips were either low or very low opportunity.

Comparatively few AAPIs live in the part of the country that offers an abundance of affordable and high-opportunity neighborhoods: the Midwest. AAPI metro residents in the Midwest experienced the highest rental affordability rates in the nation, and more than half of the neighborhoods affordable to AAPIs were high opportunity. However, only 11 percent of AAPIs living in the top 100 US metro areas resided in the Midwest in 2019, so relatively few renters were able to capitalize on these two trends.

The Western states and Hawaii also faced the steepest challenges for AAPI renters in finding affordable, high-opportunity neighborhoods. Only 22 percent of these affordable zip codes were ranked as high opportunity in 2019, the lowest such rate nationwide. In turn, the West and Hawaii was the only region where more than half of all affordable neighborhoods for AAPIs were ranked as low or very low opportunity in 2019.

At the same time, the relative severity on the West Coast and Hawaii cannot overshadow the hurdles that AAPIs face in other parts of the country, from poor access to affordable high-opportunity neighborhoods to lower incomes. A comprehensive approach to housing justice in AAPI communities must take into account these distinctions within the overall landscape of rental housing in metro America.

Some AAPI Groups, Especially Pacific Islanders, Face Steep Challenges with Rental Affordability

As we discussed in the introduction, an overly generalized portrait of AAPIs as educationally and economically thriving threatens to erase important distinctions between AAPI populations and flatten the myriad forces that brought AAPI communities to the United States. Disaggregating our rental affordability data by AAPI ethnic groups reveals the degree to which some AAPI communities, particularly Pacific Islanders, face steep challenges with rental affordability across US metros.

Income levels vary widely between AAPIs with ancestry from the same region of Asia or the Pacific. It is also important to recognize that titles like “South Asian” are still umbrella identities that can mask key interethnic differences within each subgroup, even as we use these terms with this report. For instance, a detailed breakdown of median household incomes (MHIs) by nationality in 2019 reveals wide discrepancies between Indian ($120,000) and Nepali ($56,100) median incomes as well as between the median incomes of Filipino ($93,200) and Burmese ($40,000) households.

To be certain, these larger subcategories are still useful despite their limitations, as they allow us to work with the data in the first place. The aggregation of multiple national and ethnic groups into subcategories like “Pacific Islander” or “Southeast Asian” is often necessary to amass enough data points in a sample. There are not many metros with large enough populations of less common AAPI ethnic groups to produce statistically reliable median incomes. We should remember that these datasets are never wholly complete, but rather they are entry points into deeper discussions about how we can better understand income and housing inequity within communities of color.

Examining What Shapes Class Disparities between Different AAPI Groups

Class disparities between AAPI populations arise from many different factors, including:

-

Prevalence of “brain drain” immigration from East Asian and South Asian nations: A key determinant of higher median incomes among East Asian and South Asian Americans is the Cold War-era shift in US immigration policy, which prioritized migrants with applicable skills in engineering, aerospace, science, medicine, and other STEM fields. These policies lifted decades-old immigration restrictions against Asian migrants, and in the last half-decade have engendered waves of relatively high-educated laborers from South and East Asian nations.1 2 While this is not to say that migrants from South Asia and East Asia are universally higher-income, the economic imperatives of US immigration policy have had concrete effects on the class composition of many AAPI communities.

-

Legacies of colonialism, imperialism, and US militarism in Southeast Asia and the Pacific: The Philippines and Hawaii were among the first overseas US colonial territories, seized via warfare and the overthrowing of indigenous governments in the 1890s.3 Moreover, Southeast Asia and the Pacific served as theaters for multiple US foreign interventions in the post-World War II era, including the establishment of island military bases, US-backed dictatorships, and wars of aggression in Vietnam, Laos, and Cambodia. These Cold War conflicts led to the deaths of millions and forcibly displaced millions more, including many immigrant and refugee populations now residing in the US.4

-

Being “late” to the shrinking welfare state of the 20th century: Some AAPI communities with critical masses in the 1950s and 1960s, such as Chinese and Japanese Americans, built some degree of upward mobility through access to the New Deal social safety net, such as large federal investments in suburban expansion and higher education. However, the New Deal welfare state had largely been shuttered by the 1980s. In turn, the low-income AAPI communities that built critical mass since then have faced less favorable opportunities for upward mobility.

Nuancing our data on rental affordability in AAPI communities is essential, as our high-level findings could inadvertently feed into the long-standing misconception of Asian Americans as a “model minority.” The model minority myth often posits that the economic and educational successes of Asian American communities, relative to other communities of color, are the result of favorable cultural practices that can overcome the mitigating effects of structural racism.5 6 AAPI activists and scholars have been debunking the model minority myth for half a century, but the model minority myth persists in popular discourse. As such, we must take care not to feed into the myth with our data analysis.

1 Mae Ngai, “Asian Immigration and the Myths Modeled around Model Minorities,” October 15, 2015, New America, newamerica.org/weekly/asian-immigration-and-the-myths-modeled-around-model-minorities.

2 Mae Ngai, Impossible Subjects: Illegal Aliens and the Making of Modern America, 2004.

3 Daniel Immerwahr, “How the US Has Hidden Its Empire,” February 15, 2019, The Guardian, theguardian.com/news/2019/feb/15/the-us-hidden-empire-overseas-territories-united-states-guam-puerto-rico-american-samoa.

4 KaYing Yang, “Southeast Asian American Children: Not the ‘Model Minority’,” 2004, The Future of Children 14:2, files.eric.ed.gov/fulltext/EJ795838.pdf.

5 Ellen D. Wu, “Asian Americans and the ‘Model Minority’ Myth,” January 23, 2014, Los Angeles Times, latimes.com/opinion/op-ed/la-oe-0123-wu-chua-model-minority-chinese-20140123-story.html.

6 Ellen D. Wu, The Color of Success: Asian Americans and the Origins of the Model Minority, 2013.

While the overall number of affordable neighborhoods for median-income AAPI renters barely declined during the 2010s, different AAPI subgroups and ethnicities had widely divergent experiences with rental affordability based on their respective median incomes. For instance, median-income Indian American households also saw a one-percentage-point decline in affordable neighborhoods between 2013 and 2019, but they still had access to the vast majority of neighborhoods. Conversely, median-income Korean American renters saw a seven-point percentage increase in affordable neighborhoods, but the increase was only up to 37 percent. Experiences could vary between ethnicities in the same regional subgroup, such as the wide disparities in affordability for median-income Filipino (a 72 percent affordability rate in 2019) and Vietnamese (32 percent) renters.

Pacific Islanders faced the harshest conditions in regard to rental affordability. Median-income Pacific Islander renters experienced the largest decline (7 percentage points) in affordable zip codes between 2013 and 2019, while also starting from the lowest baseline (30 percent, in 2013). In the 10 metro areas where we have sufficient income data for Pacific Islander residents, seven of these metros became less affordable for Pacific Islanders between 2013 and 2019. Four of these 10 metros had zero neighborhoods affordable for Pacific Islanders in 2019.

The fact that some AAPI communities with the greatest financial constraints also faced the largest declines in affordable rental markets suggests that the harmful effects of income polarization cut across AAPI communities. The higher the baseline in household income, the likelier renters are able to stay afloat despite the affordability squeezes that have imperiled working families in the past decade.

Disaggregating affordable neighborhoods by Child Opportunity Index levels for each AAPI subgroup reveals similar trends, with Pacific Islanders facing particularly low access to affordable, high-opportunity neighborhoods. East Asian and Southeast Asian households experienced a fairly even distribution of affordable neighborhoods across all opportunity levels, and a greater share of high-opportunity zip codes were affordable to South Asian renters. However, fewer than 20 percent of the zip codes affordable for Pacific Islander residents in 2019 were ranked as “high” or “very high” opportunity. Nearly two-thirds of zip codes affordable for median-income Pacific Islanders in 2019 were low or very low opportunity.

It is nonetheless important to recognize that AAPI renters from all ancestral backgrounds face housing affordability challenges, even in ethnic groups with large proportions of highly educated, high-income earners. As challenges to the model minority myth have long emphasized, a large number of seemingly well-off community members can threaten to make invisible the members of that community who are still struggling to make ends meet.

Improving Affordability for Low-Income Asian Americans and Pacific Islanders

Throughout this report, we have shown how the seemingly favorable state of AAPI renter affordability is more complex when accounting for geographic and demographic differences within AAPI communities. The high earning potential of some AAPI households does not negate the presence of many working-class Asian American communities in the same metropolitan areas. In the grand scheme, a smaller percentage of AAPI residents fall beneath “low-income” thresholds relative to the overall population in metro America. However, those low-income AAPIs still face the myriad challenges that all low-income renters face in navigating the shrinking geography of affordability that our previous report discussed. We must not lose sight of those specific Asian American and Pacific Islander households despite the high median incomes for AAPIs as an umbrella group.

In our original report, we outlined a series of policy priorities that would support the well-being of low-income renters regardless of race, including strengthening eviction protections and rent stabilization policies, expanding access to high-opportunity neighborhoods, and increasing the participation of marginalized communities in the electoral process. These universal efforts to advance housing justice would necessarily benefit AAPI renters as well.

Also noteworthy is the US Department of Housing and Urban Development’s proposed rule on “Affirmatively Furthering Fair Housing (AFFH),” an initiative for HUD to take a more active role in eliminating barriers to housing desegregation and creating equitable housing opportunities. Advocates and equity leaders must ensure that HUD embeds accountability to Asian American and Pacific Islander communities into their AFFH practices, policies, and institutions.

To that end, the particular circumstances that AAPI communities face across the country illuminate the need for additional targeted interventions, such as:

-

Ensuring the preservation of historically segregated communities, or enclaves, that function as service and community hubs for low-income, immigrant, and/or linguistically isolated AAPI residents. Many AAPI enclaves occupy the sites of formerly redlined neighborhoods, where discrimination among realtors and lenders created the long-term devaluation of land and capital in many communities of color. The relatively cheap property values in many of these communities have since made them prime sites for redevelopment, which risks the displacement of long-standing, low-income workers, families, and seniors in favor of market-rate housing and new commercial corridors. However, many low-income AAPI residents rely on the social, cultural, and service networks that have grown over decades to support local residents in these enclaves. Housing and business development policies must take into account the importance of these community hubs, so as not to sever large swaths of these communities from the networks that sustain them.

-

Building robust, affordable, and accessible public transportation systems to support residents displaced from central-city areas to the outer edges of metro areas. We heard from our community partners in multiple metro areas that low-income AAPI residents were increasingly moving from central-city areas to the outskirts of regions, oftentimes in conjunction with rising housing costs in historic immigrant neighborhoods. Many of these residents then face long commutes to their jobs or to continue receiving supportive services, attend community events, and/or shop in their old neighborhood. Families and workers who have already been displaced (or who would otherwise voluntarily live further away from the city center) need regular, reliable access to public transportation to reduce the cost and time burdens of commuting.

-

Implementing land use policies that accommodate housing development for non-nuclear family arrangements, like multigenerational households and older adults. Some community partners noted that local land use policies disfavored housing developments that would accommodate living configurations more common to AAPI families, such as multigenerational households with grandparents, parents, and children living under the same roof. While the construction of affordable housing, in general, is necessary to resolve the housing crises in many major metro areas, jurisdictions with large AAPI populations should explore zoning practices that could house a larger number of multigenerational working-class households, such as converting homes in historically single-family zoned neighborhoods to multiplex buildings.

-

Providing comprehensive language support systems and informational materials for non-English speaking residents, including non-threshold language speakers. Some states, like California, require local public institutions to provide language services and materials in areas with critical masses of non-English speaking communities. However, our community partners noted that local housing authorities and other agencies could still struggle to keep pace with translated versions of newer materials, forms, and instructions; translated materials alone could not assist residents unfamiliar with how to navigate housing markets and public services; and local governments often do not have the capacity to engage AAPI residents who speak more obscure dialects or less common languages. Local governments should work with embedded service providers with on-the-ground knowledge of harder-to-reach community members to inform and support linguistically isolated residents.

-

Strengthening tenant protections and multilingual legal aid services for residents living in informal housing situations. One common trend in our conversations with community partners was the number of AAPI tenants living under informal lease arrangements, including those with under-the-table agreements with landlords, those subletting from subletters, and those living in heavily overcrowded apartment units. Tenants in informal arrangements may struggle to pursue legal action against an exploitative landlord or contest an eviction notice. People living in illegally overcrowded units may hesitate to seek help for fear of making known their housing violation or their immigration status. Tenant protections and housing supports must accommodate those residents whose financial, linguistic, or legal constraints require them to seek shelter in these informal housing setups, without risking reprisal or justice system involvement.

Acknowledgments

This analysis would not have been possible without the hard work of many people behind the scenes. Many thanks to our colleagues — Justin Scoggins and Gladys Malibiran of the USC Equity Research Institute (ERI) and Michelle Huang, Selena Tan, and Gabriel Charles Tyler of PolicyLink — for their research and editorial contributions to this report. We also extend our appreciation to Rasheedah Phillips, Tram Hoang, and Jasmine Rangel of PolicyLink for contributing their expertise on housing justice and renters' rights.

We also would like to offer a special thanks to our partners at the AAPI-serving nonprofit organizations across the US who offered valuable insights and feedback that helped shape our research: Jennifer Lee of Asian Americans Advancing Justice - Atlanta; Duncan Hwang of the Asian Pacific American Network of Oregon; Ashley Chen and Edwin Tablada of the Chinese American Planning Council; Alex Jung and Xinyu Lin of City Fabrick; Naomi Chou and Fiona Zhou of the Coalition for Asian American Children and Families; Zowee Aquino, Mitch Chan, and Sookyung Oh of the Hamkae Center; Jeonghwa Boyle, Inhe Choi, and Hankyeol Song of the HANA Center; Gavin Thornton of the Hawaii Appleseed Center for Law & Economic Justice and the Hawaii Budget and Policy Center; Anju Chopra of the National Coalition for Asian Pacific American Community Development; Thu Nguyen of OCA-Asian Pacific American Advocates; Mary Anne Foo of the Orange County Asian Pacific Islander Community Alliance; John Chin and Yue Wu of the Philadelphia Chinatown Development Corporation; and Quyen Dinh and Kham Moua of the Southeast Asia Resource Action Center.